The global shipping industry is watching closely as the 17,859-TEU CMA CGM Benjamin Franklin successfully transited the Red Sea en route to Asia, marking the first ultra-large container vessel (ULCV) to take that route in almost two years.

NEWS & INSIGHTS

Our team doesn’t just ship your freight…we care about your cargo.

The KC Group Shipping team are synonymous with customer service excellence, merging best in class Live IT solutions with over 30 years of industry leading experience. This combined approach to your business makes us one of the most dynamic shipping and logistics groups in the UK.

We're delighted to announce that Freyt World has invited KC Group Shipping (KC) to become a member of the prestigious international logistics network - Freyt World.

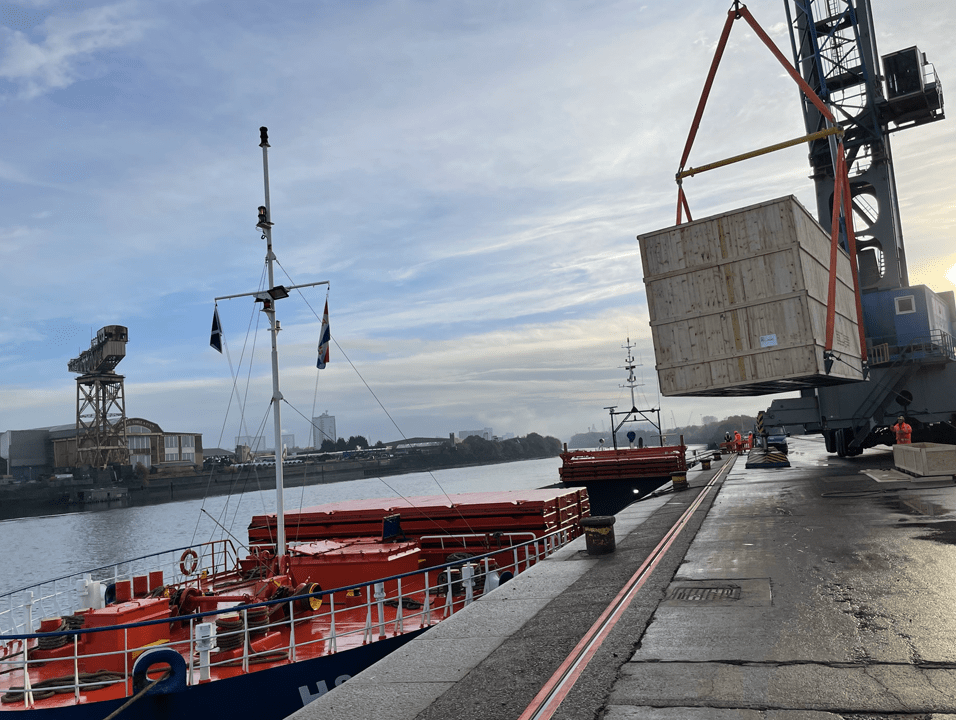

Our shared knowledge and expertise help our clients navigate the complexities of project cargo. In this latest KC In-Depth Q&A Interview, our Business Development Manager, Ewan Penman, part of our specialist cargo team, gives insight into project cargo.

This article, featured in The Herald, Business HQ Monthly, discusses David Milne’s philosophy on leadership, the benefits of nurturing internal talent, and the innovative practices at KC Group Shipping that contribute to its sustained growth and success.

KC Group Shipping Ltd is thrilled to announce that we completed the due diligence process and are now proudly recognised as a Gold Member of the Overseas Project Cargo Association (OPCA).

As part of our In-Depth Insight series, we chat with Andy Robinson, KC Group Shipping European Team Leader, to explore the Movement Guarantee - the requirements, processes and legislation.

As the festive lights sparkle and 2023 draws to a close, I extend my warmest Christmas wishes to everyone on behalf of KC Group Shipping.

KC Group Shipping Celebrates Nicole Henery's Apprenticeship Success and Nomination for Prestigious Scottish Award

The Internal Market Scheme will replace the UK Trader Scheme on 30 September 2023

We are delighted to announce that KC Group Shipping Managing Director David Milne featured as a special guest on the Hunter and Haughey Go Radio Business Show.

Chris McGowan, KC Group Shipping Operations Supervisor, looks at the latest changes to The Certificate of Origin (CO), which came into play on the 1st of April, 2023. Chris explains what these changes mean for the industry and KC Group Shipping customers.

KC Group Shipping is proud to announce that we are the United Kingdom agent and partner of the World Wine Cargo Alliance (WWCA).

In this insightful article, we look at Container Transport Unit (CTU) loading and how improper load distribution can lead to catistsphoc events and even loss of life.

David Milne of KC Group Shipping discusses customs knowledge, skills gaps, and sustainable practices as key elements for advancing the UK's export prowess. Education and digital transformation in the logistics sector are also emphasized as pivotal for future success.

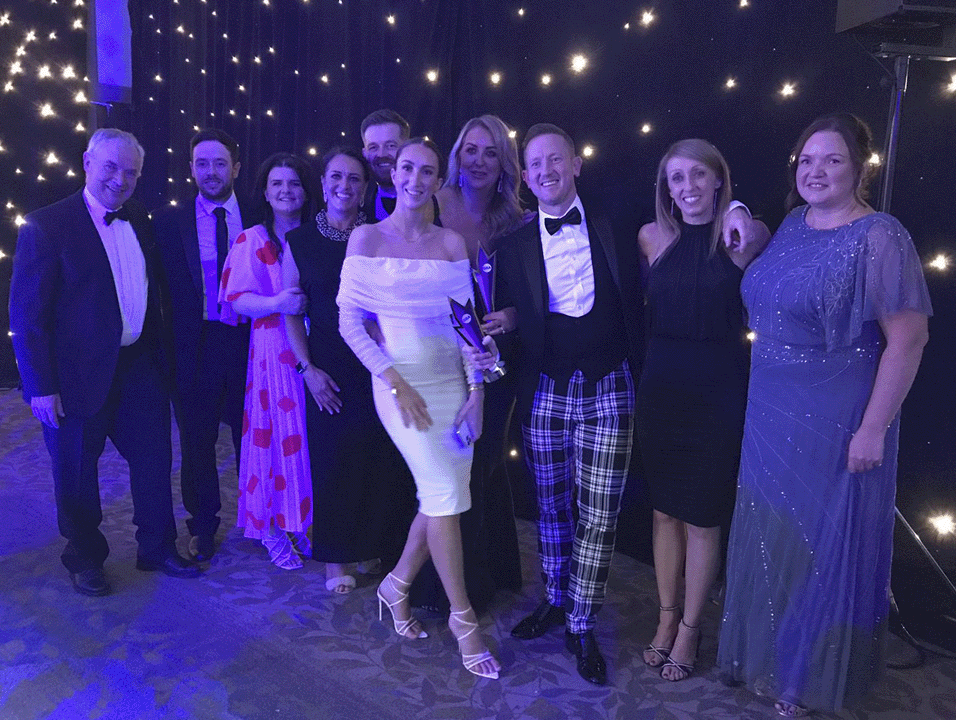

David Milne, Managing Director of KC Group Shipping, rounds up an excellent evening at the Glasgow Business Awards, 2022. Shortlisted in four prestigious award categories, David and the team at KC Group Shipping raised a toast to a successful night.